Program Highlights

-

No Income Verification

No personal income verification required; underwritten using DSCR instead of personal DTI. We take 100% to 120% of the subject rental to qualify

-

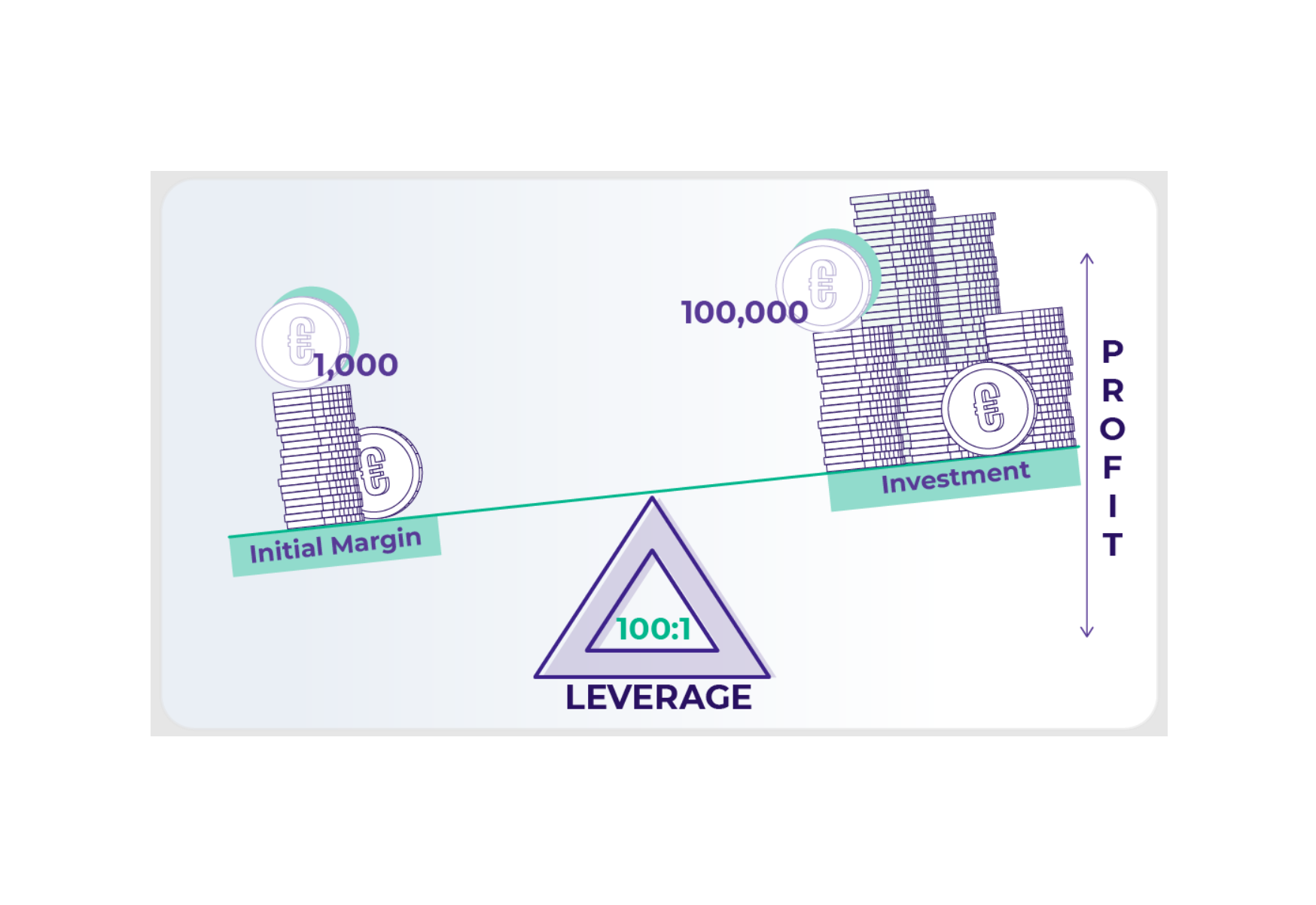

High LTV and LTC

Seeking maximum leverage? Our loan-to-value ratio of up to 80% and loan-to-cost ratio of up to 90% will minimize your down payment, optimizing your financing.

-

Competitive Rates

We partner with you to secure your deals, offering market-leading rates to keep financing costs low and drive your success.

-

Flexible Options

Close in personal name or entity with fully amortized or interest-only options, featuring a flexible prepayment penalty structure.

Our Programs

-

D S C R

Qualify based on your property’s cash flow, not personal debt-to-income. We use 100% to 120% of the rental.

-

Bank Statement

Ideal for self-employed borrowers. Use 12–24 months of bank statements to prove income.

-

P&L Only

Qualify based solely on accountant-prepared profit & loss statements without any business or personal bank statements.

-

1099 Only

Qualification based on 90% of your most recent 1099 income. No tax returns required, simplifying the process for fast and flexible financing.

-

Asset Depletion / Utilization

Using liquid assets as income for loan qualification. No tax returns needed.

-

ITIN / Foreign National

Loans available for non-residents with Individual Taxpayer Identification Number and foreign national borrowers.

-

Fix & Flip

Quick funding for purchase and renovation; draw schedules for rehab costs.

-

Bridge

Short-term financing to bridge the gap between transactions; fast approvals and funding.

-

Ground-Up Construction

Finance new construction projects with flexible terms and interest-only payments during the build.